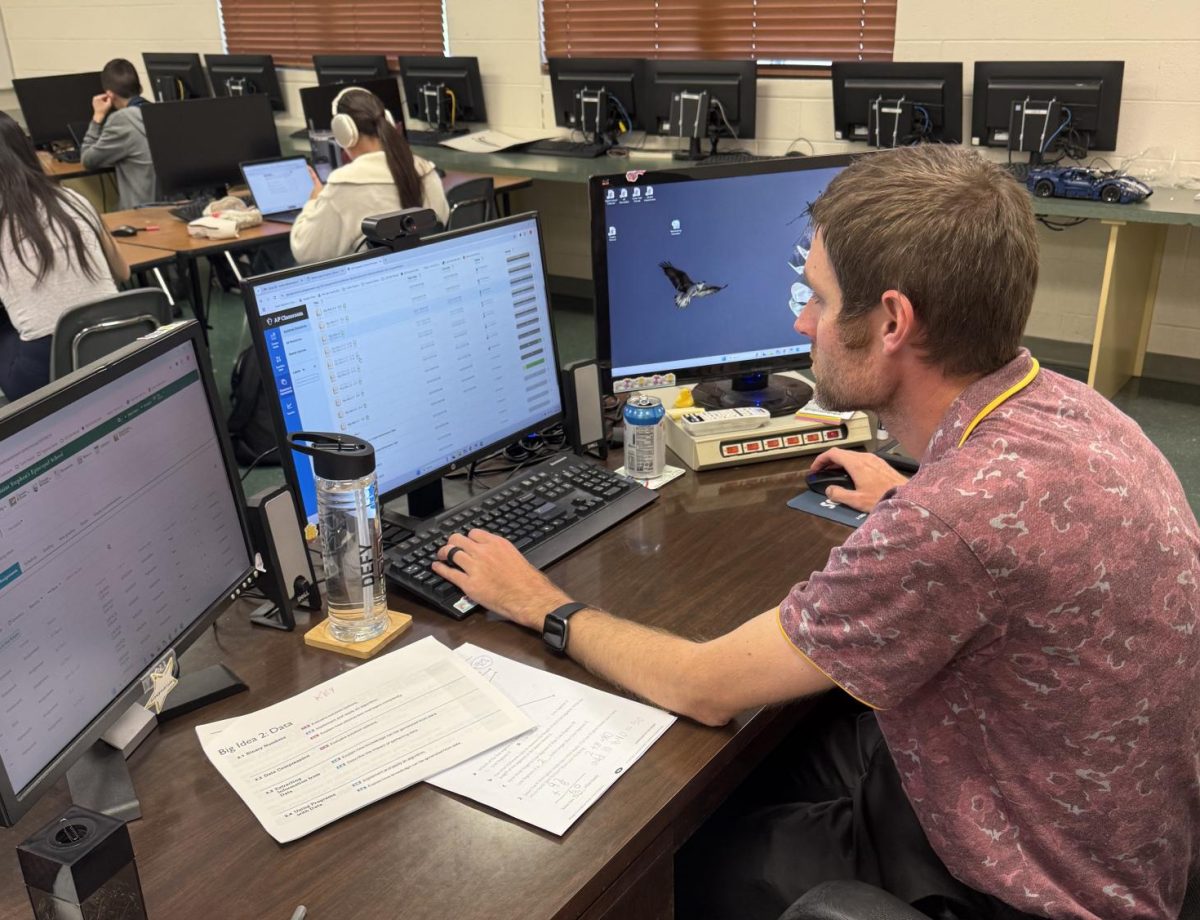

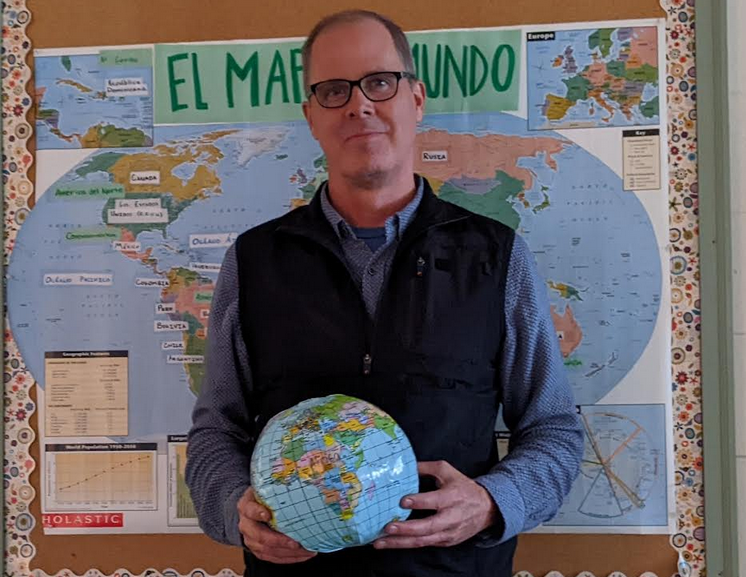

Students were strewn across the computer lab, typing on keyboards and staring intently at the bright screens. Economics teacher Mr. Bernie Yanelli entered the room, asking the group: “So, what have you found?” After completing the Know Thyself Project, Yanelli hopes the answer is “authentic independence.”

Each year, Yanelli’s Economics students are given a packet of papers and some wise words from history. The given background information reminds students, “The unexamined life is not worth living” and “To thy own self be true.” But more than just wise words from Socrates and Shakespeare, the goal of the Know Thyself Project was to have students discover how they will one day become an independent adult, both psychologically and economically.

The project required students to project into the future and calculate their total living expenses per month, including everything from car insurance to an average grocery budget. With this number and a starting salary for a career of their choice, students calculated how much money would end up in their pockets by the end of one year.

Then, with economic independence on their minds, students had to analyze their long-term goals in life and form their thoughts into an essay.

Yanelli said projects like these allow him to teach his students what he wished he had known growing up.

“One of the things that drew me to teaching was that I wanted to take my 20 years of business experience and apply it to the classroom. One of the things that I wish my teachers had encouraged more was thinking about our future in practical terms,” he said.

“Many seniors don’t know what they want to do when they graduate from college, and it doesn’t hurt to begin thinking about that and to project out and research it, to see what careers pay, what it costs to live in a particular city and how to budget out all of their necessities so they can ideally save ten percent or more.”

Show me the money

The first aspect students completed is the economic component, for which students were asked “Project out five years from now, assume you have graduated from college, and do the following:

Research and find a job in a field of your choice.

Research and find an apartment in a city of your choice.

Buy a car of your choice.

Pay off your student loans.

Create an EXCEL spreadsheet and project a monthly budget.”

Students were given equal financial situations across the board, “irrespective of your financial circumstances at home today.” Yanelli asked each student to assume he or she owes a minimum of $20,000 in student loans and that each student will pay a five percent interest rate on the loans.

The catch lies in the fact that each student is given just $10,000 from “your rich Aunt Lucy. You may buy a used car with this amount, or you may use this gift as down payment for the purchase of a car—your choice.”

Yanelli said he has shaped the project so that students fully develop their financial goals and understand the cost of monthly living.

“It’s very difficult for me to achieve a long-term goal unless I can visualize myself doing it. I hope by reflecting and writing about their future that they can draw themselves toward those goals and objectives,” he said.

To best achieve this, Yanelli asked students to “show your projected monthly/annual income (before and after taxes) and also itemize a series of expenses, such as groceries, car and health insurance, phone bill, entertainment expenses, etc.”

Of these instructions, Yanelli said it is most often the simplest of them that stumps his students.

Students, he said, most often struggle to settle on a career path for the sake of the project.

“I think it’s important that my students see this as one of many possibilities. By looking at a particular career path and what it pays in the beginning and what it costs to live in a particular city–even if they reject it because it’s too expensive or it doesn’t pay enough–at least they’ve done some analysis,” he said.

Junior Michael Berdusco said this project has opened his eyes to the many various costs and expenses he will need to pay when he gets older.

“I think it’s important for us to start thinking about our future because most of us just think about college, but that’s only the beginning step to our future lives,” he said.

“I’ll gain a realistic sense of what life after college will be like. It probably won’t be as easy as some of us thought it would be.”

Students said the Know Thyself Project brings a wakeup call to how much it will cost simply to live.

Berdusco, who hopes to someday be an investment analyst, said he was surprised when he began doing research for his potential future.

“I looked up starting salaries for potential jobs I would want. I looked at living expenses, the cost of cars and everything else. I found it’s expensive to have an apartment in the city as opposed to not in the city.”

For others, the reports heard daily on the news about unemployment issues rang true. While doing research on monsterjobs.com and other Web sites, they found the jobs they are hoping to someday do are not needed in the work field.

Senior Carlos Montero said, “I want to become a doctor, and I found there aren’t that many job openings listed online for where I want to live.”

The mindset of success

For the psychological component, students were instructed to “write a 350-500 word essay that explains what it means to you to ‘know yourself.’”

Montero said even though this project is just a set of guidelines on a sheet of paper, it has forced him and his classmates to think about the future on life-long terms.

“We have to start thinking about the important things in life—having a job and a family—and figuring out how we can fit this into our budget,” he said.

Senior Katie Carrington said, “This project really helped me to open my eyes to all of this. I’ve never really taken the time to think about my future and how I perceive myself.”

“It’s great that I’m able to think about it in such detail before going off to college where I will shape my identity even more,” she said.